AWARD WINNING, AND LIVE ACROSS THREE CONTINENTS

merchants worldwide

annual transactions

data processed daily

UNLOCKING THE POWER OF PAYMENTS DATA

Cost savings, revenue opportunities and a great customer experience…

Get to market fast, whatever legacy infrastructure banks have

The Pollinate Platform is designed to (non-invasively) ingest many different types of data feeds – securely and in compliance with banking and privacy regulations in different parts of the world.

Create market-leading SMB propositions

Small and medium businesses are a critical customer segment for banks as they look to adopt more and more digital payments and banking services. Our go to market expertise and flexible deployment strategies enables winning, bank owned and bank branded solutions.

Optimise back office and customer support

In the age of rapidly growing digital competitors, reducing the overhead of traditional customer support is vital. By onboarding in just a few minutes, and providing online statements and business insights in a single hub, cost to serve is massively reduced.

Six products powered by payments and bank data

Onboarding

Fast and engaging for bank customers

Our onboarding process delivers a quote in 90 seconds and the sign up process takes as little as 5 minutes. Our journey allows necessary checks (e.g., AML, Credit Risk) through APIs. These checks are customizable based on bank’s requirements.

A library of configurable components is used to assemble personalised onboarding journeys. Merchants benefit from digital onboarding, and the ability to switch between digital and assisted journeys.

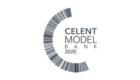

Transactions management

Multiple data sources in one place

- All stores

- Online and offline transactions

- All digital transaction types

- All schemes

Your SMBs get complete traceability on transactions and settlements, increasing transparency and reducing reliance on statements and call centres.

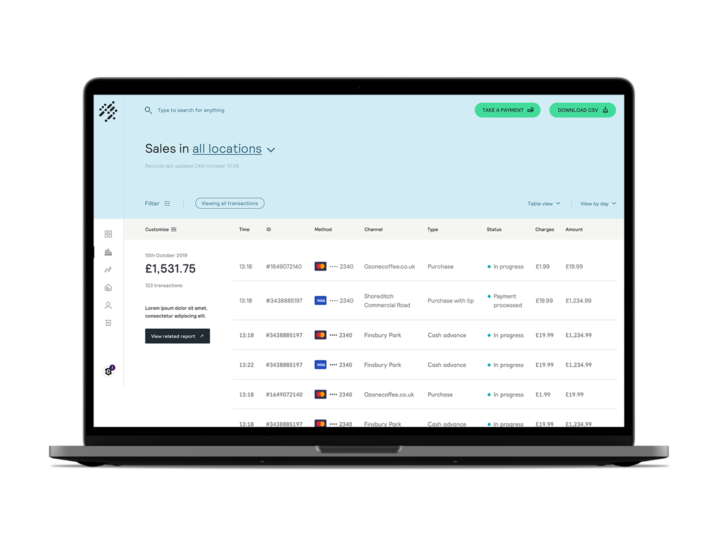

Merchant insights

Powerful data and analysis

Give your SMBs access to detailed data usually only available to large retailers.

ATV trends, revenue trends, historical comparisons and more.

With issuing data integrated, we enable small businesses to understand customer demographics, attitudes, and travel patterns.

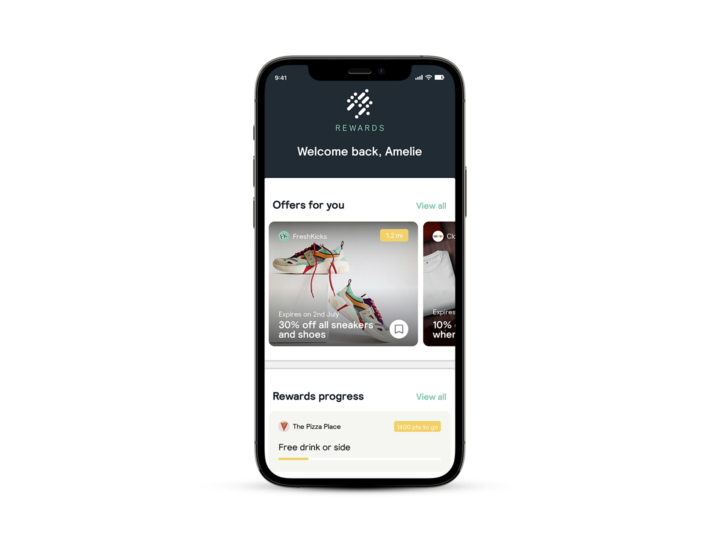

Merchant marketing toolkit

Loyalty and offers to help SMBs grow

A payment-linked loyalty platform, enabling merchants to create, publish and manage offers and rewards for their customers in one place. With interchange regulated in many markets, reward schemes from issuers are in decline. Our platform enables merchants to control and fund their own rewards.

Built to make redemption easier for merchants and customers by leveraging well-understood mobile loyalty process. Using the power of bank data to close the loop between merchants and consumers – delivered to consumers through a mobile app.

Data ingestion and security

Your choice of implementation path

Simple implementation

The Pollinate Platform can be deployed however it suits our client banks: we can deliver a range of ‘ready to use’ bank-branded products; to provide configurable front ends for bank deployment; or simply output API feeds to integrate into their current infrastructure.